WORLD AND REGIONAL TOURISM

The tourism sector expanded in 2012. Global

international tourist arrivals increased by 4.1%

to 1,035 million in 2012, up from 995 million

in 2011. Emerging economies topped the list in

international tourist arrivals recording a growth rate

of 4.3%, while advanced economies recorded a

growth of 3.8% in 2012. The direct contribution

of tourism to global GDP in 2012 was USD 2,065

billion; equivalent to 2.9% of global GDP, and

expected to rise by 3.1% to USD 2,120 billion

in 20131.

1AACO Annual Report - 2013

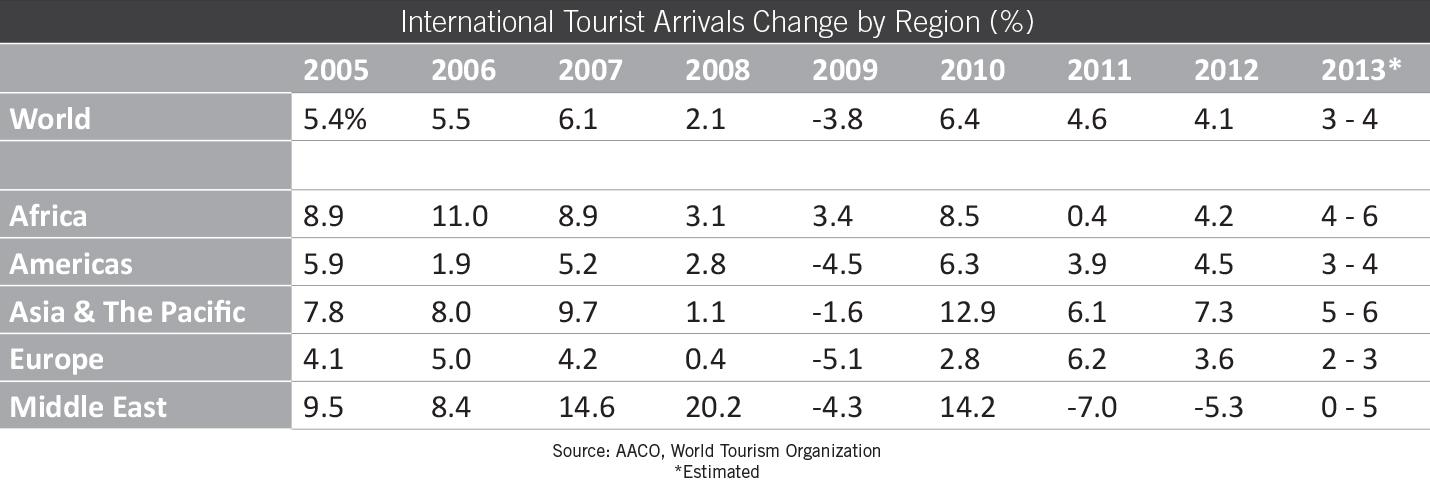

Asia and the pacific recorded the highest growth rate among regions at 7.3%, followed by the Americas at 4.5%, Africa at 4.2%, and Europe at 3.6% slipping from 6.2% in 2011. On the other hand, the Middle East witnessed a decrease in the number of tourist arrivals by (5.3%) in 2012. Although the total is subdued due to the social and political unrest in the region, tourist arrivals in the Middle East have gained some strength in 2012 especially after the rebound of that sector in Tunisia2.According to the UN World Tourism Organization, international tourist arrivals are expected to grow between 3% and 4% during 2013, and the world is expected to attract 1,086 million tourists in 2013. On the regional level, the UNWTO forecasts an increase in Europe and the Americas between 2% and 4%, in Asia and the Pacific between 5% and 6% and between 0% and 5% in the Middle East which will highly depend on the political stability of the region.

IATA’s most recent air freight market analysis, published 1-Oct-2014 said, "the outlook for air freight markets has started to look better again."

2 World Tourism Organization

3 IATA

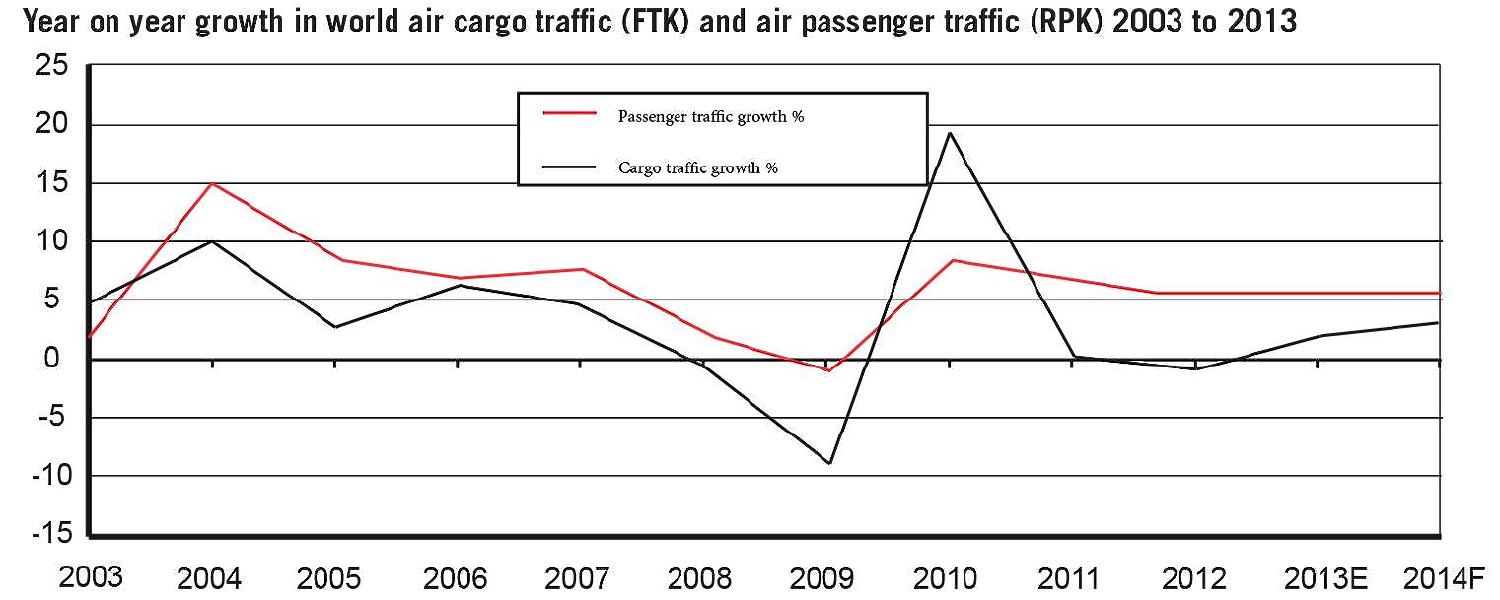

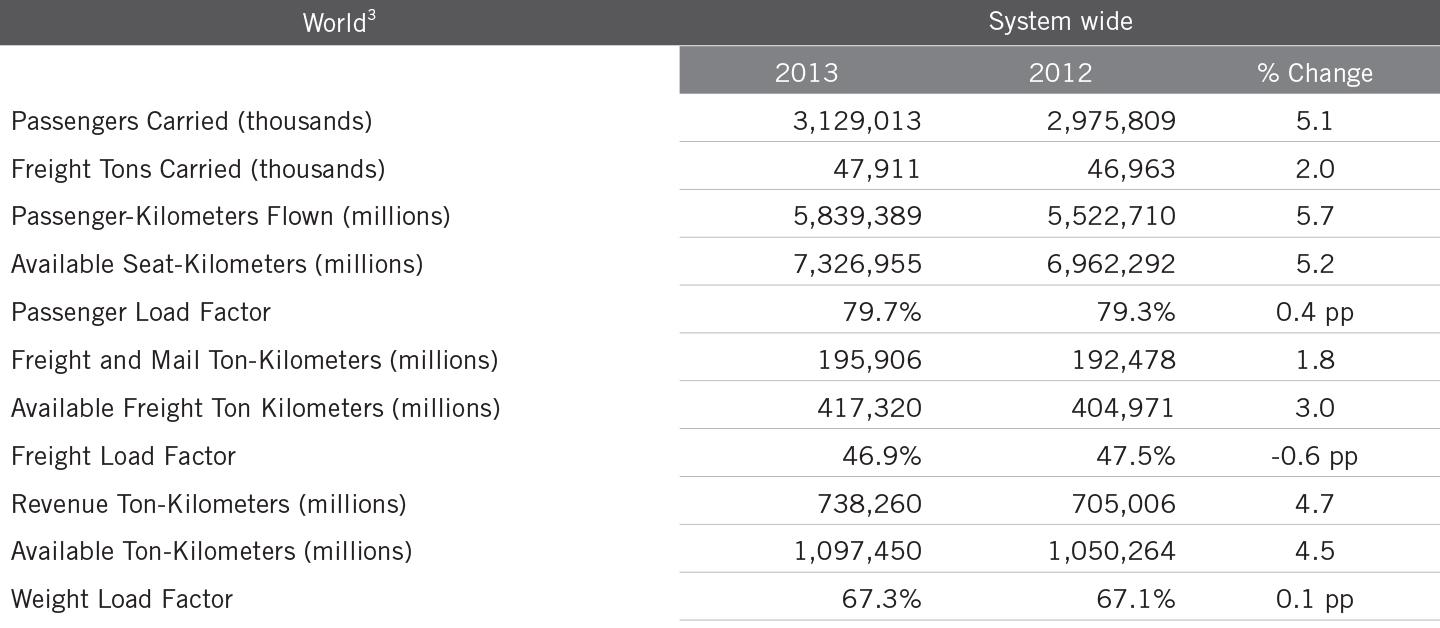

However, air cargo faces much more fundamental problems. It accounted for just 8.6% of total airline industry revenue in 2013, down from 12.4% a decade earlier. Freight load factor was just 45.3% in 2013, compared with almost 80% for the passenger business. With the exception of 2010, cargo traffic growth has been weaker than passenger traffic growth every year for the past decade. Since the global financial crisis, freight volume growth outpaced passenger volume growth only in 2010, when cargo led a bounce back in airline profitability. Over the 10 year period 2004 to 2013, the average passenger traffic growth rate was 6.5%, but just 3.5% for freight. Moreover, cargo traffic growth was negative three times in the 10 years, compared with just once for passenger traffic.3

3 Source: CAPA Study