RI Workshops returns with further events for 2019.

This year we are pleased to announce global workshops focussing on:

|

|

|

How it works

The RI Workshops are forums primarily for asset owners to discuss and share knowledge. They are meant to stimulate conversations amongst like-minded peers who want to share and learn how to navigate ESG investment risks and about cutting edge ESG investment solutions or thematic investing strategies.

|

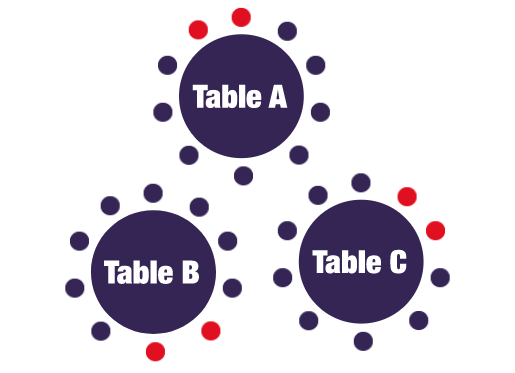

Workshops may take three forms: 1. Multi-table format. This will include 3 separate thematic sessions. The delegates will be assigned tables randomly and will be expected to move to a different table during the short breaks between the group discussions. This is to allow participants to connect with as many different people as possible throughout the day. There is a moderator at each table who guides the discussion points, which will be sent in advance. We highly encourage all participants to engage in these table discussions by sharing experiences, ideas, and raising questions where appropriate. |

|

2. Multi-table format with panel. This includes a short presentation of RI branded materials (e.g., an infographic) that help to “set the scene” for the day’s discussion. This is followed by one overarching thematic panel discussion. The panel will be moderated by the RI workshop lead. The delegates will be assigned tables randomly and will be expected to move to a different table during the short breaks between the group discussions. This is to allow participants to connect with as many different people as possible throughout the day. There is a moderator at each table who guides the discussion points, which will be sent in advance. We highly encourage all participants to engage in these table discussions by sharing experiences, ideas, and raising questions where appropriate.

3. Seminar-style workshop. This will include up to 3 panel sessions to discuss sub-themes of an overarching thematic subject. In these moderator-led panel sessions, there will be opportunities for attendees and panellists to share experiences, ideas and raise questions during the Q&A portion of each session and during the short breaks between panels.

Who can attend?

| Public Pension Funds Corporate Pension Funds/Plan Sponsors Insurance Funds (Asset-Liability Management) Endowments Foundations |

Sovereign Wealth Funds Large Family and Multi-Family Offices Fund Selectors (Non-proprietary and open architecture platforms) Central Banks Pension Consultants (Non-Discretionary)* |